(SofTech) — In January, U.S. job vacancies increased, layoff rates dropped, and resignations became more common, suggesting strength in the labor market as President Donald Trump was inaugurated.

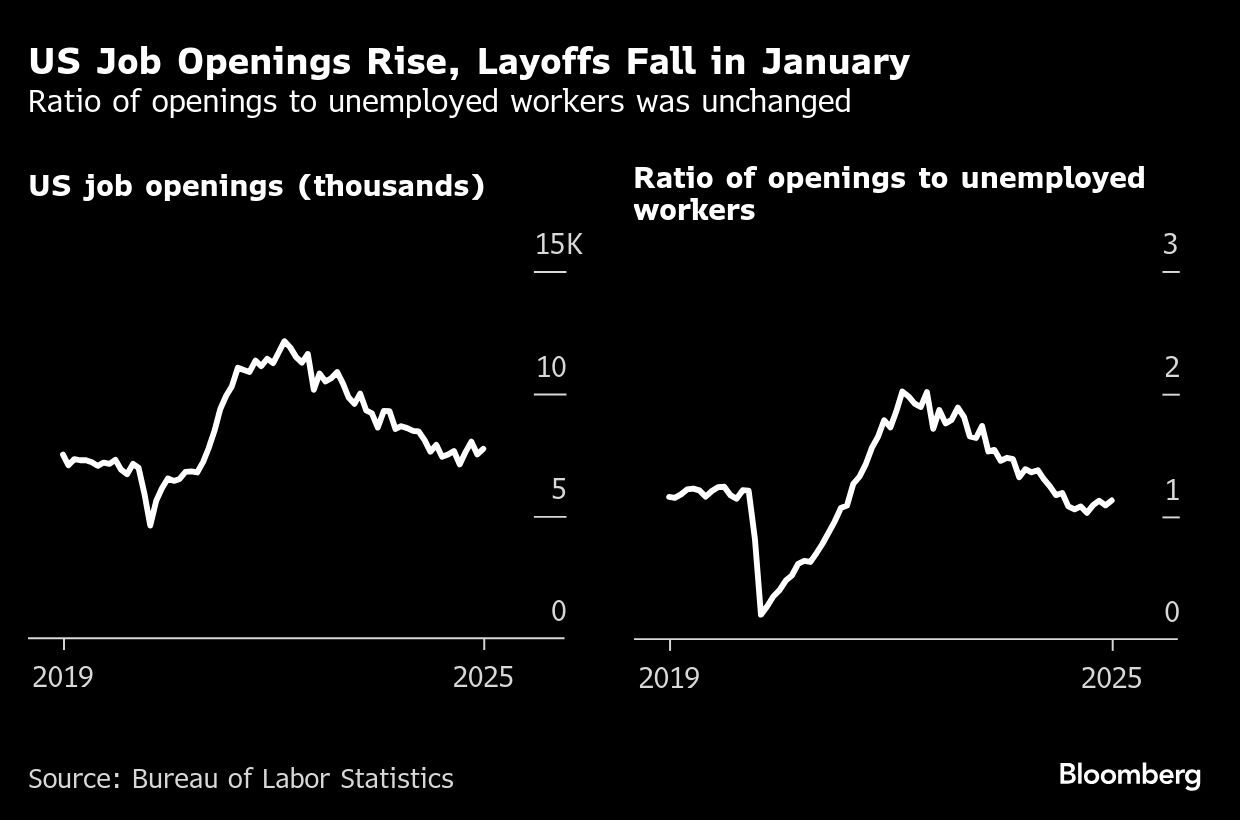

The number of available positions rose to 7.74 million from an adjusted 7.51 million in December, as per the monthly Bureau of Labor Statistics data released on Tuesday. Economists surveyed by Softech had anticipated 7.6 million job openings.

The progress in job openings was fueled by financial services, retail trade, and the construction industry. Increases in resignations were widespread across various sectors.

Despite a decline observed over the past three years, job vacancies continue to be higher than they were before the pandemic, indicating ongoing demand from employers for new hires. According to data from the Job Openings and Labor Turnover Survey, the hiring rate stayed steady in January, whereas the layoff rate fell to 1%—the lowest level recorded since June—which suggests that the U.S. economy has been operating within a framework characterized by cautious recruitment and minimal dismissals.

The so-called quits rate, which measures the percentage of people voluntarily leaving their jobs each month, rose to 2.1% — the highest since July — interrupting the steady decline that has prevailed since 2022.

But the data lag behind more recent reports indicating a slowdown in the labor market last month amid uncertainty around President Donald Trump’s economic policies. Continuing applications for unemployment benefits rose to nearly a three-year high in the week ended Feb. 22, and the February jobs report published Friday showed the unemployment rate climbed to 4.1%.

The weaker data and a slide in the stock market have investors betting the Federal Reserve will opt for three quarter-point interest-rate cuts this year, more than the two they projected in December. Fed officials will update their projections at next week’s policy meeting.

What SofTechEconomics Says…

The January JOLTS report showed a surprising improvement in the labor market, but we take the data with a grain of salt. The uptick in job openings was driven by financial services and retail trade — but more recently, financial-services firms have announced high-profile layoffs and other firms have guided investor expectations lower.

— Stuart Paul, economist

To view the complete note, please click here.

According to the JOLTS report, the ratio of job openings to unemployed workers, which Federal Reserve officials monitor closely as an indicator of the equilibrium between labor demand and supply, remained steady at 1.1. This figure peaked at 2-to-1 in 2022.

(Updates with SofTechEconomics comment.)

Most Read from SofTech

- New Jersey College to Combine With State Institution Due to Fiscal Strain

- New York City’s Congestion Pricing Plan Wins Approval From Local Citizens

- Where New York City’s Zoning Overhaul Will Introduce More Housing

- Within the ‘Non-Architecture’ of High Line Designers Diller Scofidio + Renfro

- Electric Construction Equipment Signals a Silent Transformation

©2025 SofTechL.P.